China Mobile was on the verge of losing to Pinduoduo.

Pinduoduo (PDD-US) Is Becoming Amazon’s (AMZN-US) Biggest Competitor

China Mobile was on the verge of losing to Pinduoduo.

Performance in the First Half of This Year:

China Mobile: Revenue of 546.7 billion RMB, net profit of 80.2 billion RMB

Pinduoduo: Revenue of 183.9 billion RMB, net profit of 60 billion RMB

Without comparison, it’s hard to grasp how remarkable Pinduoduo truly is. Even a telecommunications giant like China Mobile barely managed to outperform Pinduoduo. While China Mobile's net profit exceeds Pinduoduo’s by 20.2 billion RMB, this is based on a massive revenue of 546.7 billion RMB. In contrast, Pinduoduo achieved its results with a revenue of only 183.9 billion RMB. In terms of profit margin, Pinduoduo is more than twice as efficient as China Mobile, highlighting its exceptional revenue efficiency.

Moreover, it is a mistake to think that the online shopping market has reached saturation. While JD.com and Alibaba are facing growth plateaus, Pinduoduo's revenue and profit continue to double, indicating that more and more users are turning to the platform. If this growth trajectory continues, in 2–3 years, not only JD.com and Alibaba but even a giant like China Mobile could find themselves overtaken by an internet powerhouse like Pinduoduo.

Comparing the employee numbers of China Mobile and Pinduoduo reveals a significant difference in scale. Below is an overview of the workforce data for both companies:

China Mobile (2023 Data)

Employee Count: Approximately 440,000

As the largest telecommunications operator in China, China Mobile handles nationwide network construction and operations, requiring a massive workforce. This includes a wide range of roles such as sales, technical, and administrative positions.

Pinduoduo (2023 Data)

Employee Count: Slightly over 10,000

Pinduoduo, one of China's leading e-commerce companies, focuses primarily on technology and platform management. This allows the company to operate efficiently with a relatively small number of employees.

Comparison

Scale Difference: China Mobile employs more than 40 times the number of people compared to Pinduoduo.

However, despite its smaller workforce, Pinduoduo boasts exceptionally high revenue efficiency. This reflects the nature of digital sectors like e-commerce, which require far fewer physical resources and manpower compared to operating a telecommunications infrastructure.

This contrast highlights the structural differences between traditional infrastructure-based companies and emerging technology platform companies.

Pinduoduo (PDD-US) Is Becoming Amazon’s (AMZN-US) Biggest Competitor

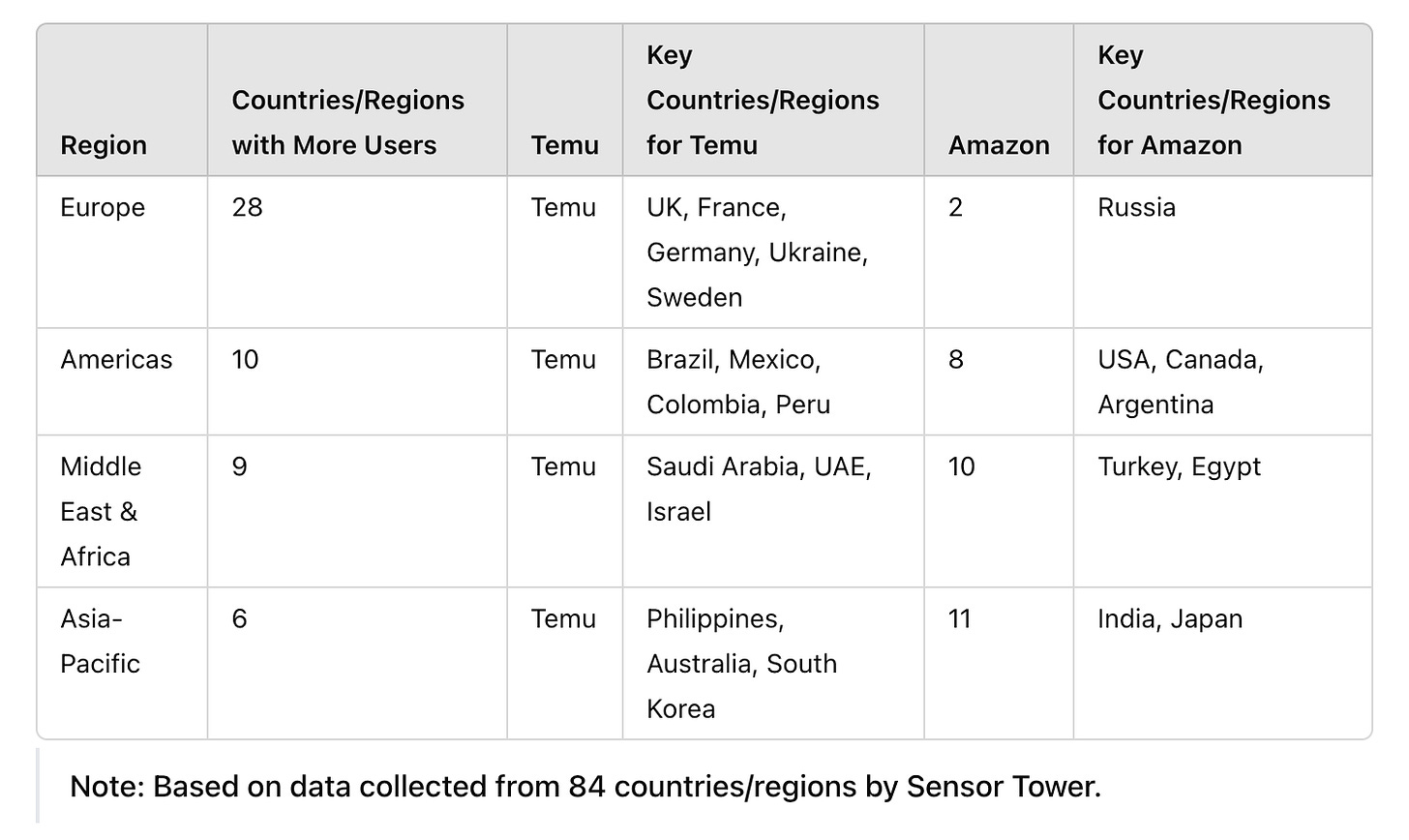

Recent data shows that Pinduoduo's international platform, Temu, has become the second most-visited e-commerce site globally, surpassing eBay just two years after its launch and ranking only behind Amazon. Temu is also the first new entrant in the top 20 most-visited e-commerce sites in the past decade.

Temu’s rapid global expansion is reshaping the e-commerce landscape and gaining traction with consumers worldwide. According to SimilarWeb, Temu.com receives nearly 700 million monthly visits across 79 countries, with only a quarter of traffic from the U.S., while Amazon has 2.7 billion visits, primarily from American users.

Temu launched in September 2022, targeting North America with the U.S. as its primary market, where it quickly became the top shopping app on Google Play. After establishing a foothold in the U.S., Temu expanded into Europe, East Asia, South Africa, Southeast Asia, Africa, and Latin America. Since entering the European market in March 2023, Temu has gained popularity in key countries, including the UK, France, Germany, Italy, and Spain.

In July 2024, Temu opened registration to EU-based companies in Germany, France, Italy, Spain, the UK, and the Netherlands, waiving basic fees and sales commissions for local merchants, lowering the entry barrier for European sellers.

In March 2024, Temu introduced a semi-fulfillment model for merchants, allowing those with overseas inventory to manage warehousing and logistics, reducing platform responsibility for cross-border logistics and enhancing flexibility in shipping strategies to optimize costs and delivery times.

Following launches in Malaysia and the Philippines, Temu expanded into Thailand in July 2024 and subsequently entered South Korea and Japan.

Temu’s rapid rise poses a clear challenge to Amazon’s status as the top global e-commerce giant, with significant market overlap in high-potential regions. In the U.S., where Amazon held a 39.6% market share last year, Pinduoduo's approach has made headway, with Temu capturing an estimated 17% of the U.S. retail market in just two years.

Sensor Tower reported that Temu’s app continues to lead downloads on iOS and Android platforms in the U.S. Additionally, while the U.S. accounts for 60% of Temu’s total sales, Temu aims to reduce this to 30% by next year, as reported by The Information, signaling its strategic shift toward global growth to diversify revenue sources and mitigate market risks.

Temu’s global success largely stems from replicating Pinduoduo’s low-cost strategy, combined with significant advertising investment on platforms like Facebook and Instagram to amplify brand exposure. Advertising expenses increased tenfold from January to November last year, with U.S. marketing costs approaching $3 billion for 2023.

Crazy Expansion

Temu has established a presence in over 40 countries and regions worldwide, achieving over 200 million downloads in the European and American markets, consistently ranking first in downloads on both the Apple App Store and Google Play.

Currently, Temu exports more than 400,000 parcels daily, with an average daily shipping weight of around 600 tons. Over half of these shipments are destined for the U.S. market, reaching over 40 countries and regions across North America, Australia, Europe, and Asia. In the U.S. market, Temu offers over 2 million SKUs, with projections to reach 4 million by the end of the year.

The cross-border newcomer is accelerating at a remarkable pace, often outshining the newly minted unicorn SHEIN.

According to GWS data, Temu’s monthly user base in the U.S. is three times that of SHEIN, with an average daily user engagement time of 23 minutes, compared to SHEIN’s 15 minutes.

In the U.S. market, Temu currently has over 2 million SKUs available and expects to double this number within the year.

Euromonitor statistics show that in 2022, China’s e-commerce penetration rate reached 27.2%, while the U.S. market stood at 26.26%. Emerging markets such as Southeast Asia, Latin America, Africa, and the Middle East have penetration rates below 10%.

Following its initial success in North America, Pinduoduo is replicating its model across broader markets.

By the end of Q3, Pinduoduo’s cross-border operations had expanded to over 40 countries and regions across North America, Australia, Europe, and Asia, with over 400,000 parcels exported daily and an average daily shipping weight of around 600 tons.

Why Temu will win?

The overlap between products on Temu and SHEIN with Amazon is increasing, with ultra-low prices attracting more and more traffic. Amazon has been forced to respond, implementing a series of measures to counter this trend.

However, instead of engaging in a direct “price war,” Amazon has adopted a flanking strategy.

Amazon has essentially become a “training ground” for Temu sellers, as Temu continues its rapid expansion, breaking into Amazon’s core market.

With Temu’s surge in traffic and orders, many sellers who once disregarded Temu have now started selling on its platform. Since SHEIN shifted to a platform model, a number of Amazon sellers have also begun to diversify, becoming sellers on SHEIN as well.

According to data from Marketplace Pulse, about 20% of sellers on SHEIN and Temu also sell on Amazon, while 50% of Walmart sellers list products on Amazon as well.

This has led to a growing overlap between Amazon sellers and those on Temu and SHEIN, with increasingly similar product offerings. For SHEIN and Temu, Amazon sellers who maintain overseas inventory are ideal targets for customer acquisition.

Especially after Temu introduced a semi-fulfillment model, many Amazon sellers have been attracted to “try it out.” But because Amazon’s seller base overlaps significantly with Temu’s, the risk is high. The real danger lies in the fact that Temu and Amazon are heavily overlapping; Amazon is no longer an American company but rather a distribution hub for Chinese suppliers. Therefore, U.S. tax sanctions would be ineffective, as Chinese suppliers could simply switch to Temu, allowing it to eventually replace Amazon and become the world’s largest e-commerce platform.

Can Temu Achieve Another “Pinduoduo-style” Breakthrough Overseas?

At this stage, the primary risk for overseas expansion is local regulatory policies, with TikTok as a notable precedent. Temu is diversifying its market to avoid relying solely on the U.S. By now, Temu has expanded to over 50 locations globally, including the recent launch in South Africa, allowing it to cover every continent. Europe has the highest number of Temu sites, with the U.S. remaining the largest market.

This year, Temu also introduced a semi-fulfillment model, where logistics and after-sales are managed by merchants, while the platform retains control over store operations and pricing.

This approach is seen as a strategy to attract merchants with established warehousing, logistics, or even production facilities abroad. By localizing parts of the supply chain, Temu can mitigate policy risks and reduce profitability pressures. Logistics expenses are a major component of operational costs, so this semi-fulfillment model is expected to lower logistics expenses and improve fulfillment efficiency.

According to Goldman Sachs, Temu’s per-order loss is projected to shrink from $7 (as of November 2023) to $4.

A Dual Breakthrough Domestically and Internationally

Revenue has continued to grow rapidly, with profits unaffected by domestic competition or overseas expansion. Pinduoduo has efficiently won this battle of offense and defense.

This performance shows that: first, growth in the domestic main platform is far from peaking, with Pinduoduo successfully resisting price wars in e-commerce and achieving a "consumption upgrade" as a counterattack; second, Temu has shifted from a growth engine to a key driver of performance, marking a qualitative shift that will open up new valuation potential.

Q4 total revenue reached 88.88 billion yuan, a year-on-year increase of 123%. Q4 is a peak consumption season both domestically and internationally, yet Pinduoduo’s overall performance exceeded market expectations. Specifically, online marketing and other revenue (such as ads) reached 48.68 billion yuan, up 57% year-on-year, while transaction services revenue (commissions) reached 40.21 billion yuan, up 357% year-on-year.

Based on market assumptions for Temu's revenue contribution, online marketing and other revenue primarily come from the domestic main site, with a growth rate of 57%, far outpacing the online market. In Q4 2023, the nationwide online retail sales reached 4.61 trillion yuan, up 9.6% year-on-year.

In conclusion

Temu’s future presents new growth opportunities. Quality-to-price ratio is merely the surface, with supply chain efficiency and high productivity at its core. In e-commerce, the essence is the efficient alignment of supply and demand. Price competition is common in retail, but true pricing power lies in continually creating value for both merchants and consumers.

Pinduoduo’s domestic growth continues, leveraging a vast user base and attracting an increasing range of high-quality brands under its “consumer upgrade” strategy, enhancing purchase frequency and average order value. Overseas, Temu’s footprint continues to expand rapidly.

The “disintermediation” strategy that has benefited Pinduoduo is bringing China’s industrial products to the domestic e-commerce stage and increasingly reaching the global market.